Missouri’s Tax for Children: An Investment That Counts

For almost 25 years, the Family and Community Trust (FACT), working closely with 20 Community Partnerships across the state, has had communities as the focal point of efforts to improve the quality of life for Missouri families and children. Each year, FACT (with funding from the Annie E. Casey Foundation) supports KIDS COUNT in Missouri to disseminate information on the well-being of children in our state. In the most recent release of the Missouri KIDS COUNT Data Book (2016), a narrative on “Why Community Matters” drew attention to the various challenges that children in Missouri face in their surroundings and social environment. This is why FACT and Missouri KIDS COUNT support the communities that have implemented the Missouri Community Children’s Services tax, a legislatively created, voter-approved effort to respond to the behavioral health needs of children, thereby strengthening families and the communities in which they live.

Brief History

In 1993, during the 87th General Assembly of the Missouri legislature, former Senator Harold Caskey sponsored two state laws (RSMo 210.860–861) that were passed to establish what would come to be called the Community Children’s Services Tax. These laws presented an opportunity for all Missouri counties and the City of St. Louis[1] for a voter-approved property tax to support children 18 years of age and younger. The laws passed with only one nay vote.[2]

In 2000, the General Assembly expanded this opportunity by passing an additional law (RSMo 67.1775.1) to include a voter-approved sales tax to establish a Community Children’s Services Fund. This law passed without any nay votes, expanding the type of levy and coverage to children 19 years of age and younger.

These taxes, after approval by a majority of voters, are specifically designated to fund services to protect the well-being and safety of children, to strengthen families, and to promote healthy lifestyles among children and youth, with a focus on behavioral health.[3]

These statutes together prescribe basic requirements but also allow for local control. Local governmental authorities, whether it be the County Commission, or through a local ordinance, prescribes the makeup of the governing board and its responsibilities, in accordance with the statute. For the property tax, the governing board is responsible for administering and expending all funds. In this case, the funds are maintained by the locale’s county treasurer. For the sales tax, the funds are managed by the Missouri Director of Revenue and held in a special fund by the Missouri State Treasurer.

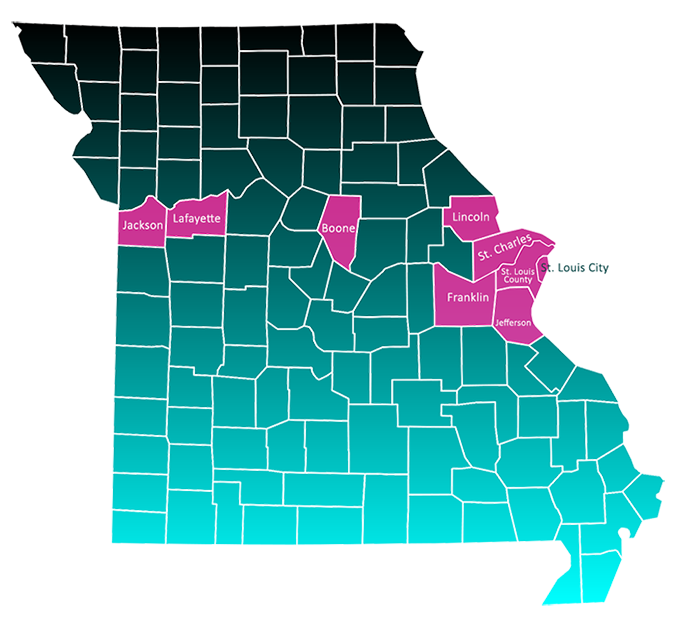

In November 2016, Jackson County was the latest to pass a Community Children’s Services Tax. There are now nine counties (i.e., St. Charles, Lincoln, Boone, Franklin, St. Louis County, Lafayette, Jefferson, Jackson and the City of St. Louis) that have passed either a sales or property tax levy on behalf of children and youth.

The citizens of these communities have made an explicit commitment to improving the lives of children through what is often an unpopular ask for voters—a tax. Missouri KIDS COUNT and FACT applaud these communities of voters whose collective voices on behalf of children are manifest through this tax and what it does. The following section includes brief summaries of each of the eight communities that have implemented the tax along with inspirational stories illustrating how the tax is changing the lives of children.

Significance

The establishment of the Community Children’s Services Fund has fundamentally changed the way in which children’s behavioral health is addressed in Missouri. Although there are some restrictions regarding the services that can be provided with the fund,[4] in general, local administrative entities have the autonomy to decide which services are provided in their county. Each county is responsible for identifying needs and gaps, monitoring utilization, and assessing the impact of the services provided.

Before the Community Children’s Services Fund, the services available to address children’s behavioral health were limited and fragmented. Thanks to the fund, collaborations among service providers, agencies, organizations, and schools have emerged, creating more efficient systems of care. Instead of competing for resources, people are working together to find solutions. The fund has fostered collaborations that are systematically reducing previous barriers to care.

Behavioral health is an essential component of overall well-being. It can dictate whether a child can become a productive adult that contributes to his or her community. The counties that have established the Children’s Services Fund understand that investing in child behavioral health is investing in the future of their communities. If you are interested in learning more about why it is important to invest in children’s behavioral health, we have included links to resources at the end of this article.

Conclusion

“Local dollars, local kids, local oversight” are six words that capture the unique value of the Community Children’s Services Tax. All decisions, from voter approval to fund allocation, are made at the local-level. The tax is unique in that it gives each county the ability to customize how funds are used depending on the particular needs of the community. The Community Children’s Services Tax is not intended to supplant or to diminish the critical role that state dollars and agencies must contribute to our children’s health. The needs are countless and the resources are limited for children’s behavioral health—even in communities with dedicated revenue. The communities that have implemented this tax are fully aware that it cannot solve all the social distress, but rather see it as the starting point to begin developing systems of care that are effective, cross-cutting and contextualized.

To the leadership in these counties who put the Community Children’s Services Tax on the ballot, to the voters who approved this tax, and to the executive directors and boards that manage and fund services, Missouri KIDS COUNT celebrates your commitment to children.

To any counties considering a Community Children’s Services Tax, there are eight outstanding directors and boards from which to learn. Even without the tax in place, we encourage counties to contact fund leaders to learn about best practices and effective interventions and preventions.

We want to personally thank the leaders of each tax entity—Bruce Sowatsky, Jama Dodson, Ghada Sultani-Hoffman, Tiffany Dehn, Cheri Winchester, Annie Foncannon, Connie Cunningham, and Kelly Wallis—for their efforts in helping us write and edit this article, and for serving as an example to other communities for how to collaborate, address shared challenges and build effective systems of care for children.

Finally, we want to acknowledge the foresight of the Missouri legislature. In 1993, when this law was passed, the legislature understood the power of community support in children’s lives, but likely did not anticipate all of the benefits flowing to children and their communities from this tax. It serves as an effective gateway to individual children, to providers, to families and to the community at large, offering training, education, collaboration, expertise and connectedness. We thank the Missouri legislature on behalf of Missouri’s children for their ongoing support for this local tax opportunity.

Resources

Learn more about the impact of children’s behavioral health by visiting the websites and reading recent Missouri research below:

- Center for Disease Control and Prevention—Children’s Mental Health Report

- Substance Abuse and Mental Health Services Administration—Caring for Every Child’s Mental Health

- American Academy of Pediatrics—Promoting Children’s Mental Health

- HIDI Health Stats, Missouri Hospital Industry Data Institute—Building Resilience Around Trauma and Adverse Childhood Experiences: Identifying High-Risk Communities in Missouri and Kansas

- Washington University—Nurturing During Preschool Years Boosts Children’s Brain Growth

- Washington University—Poverty Linked to Childhood Depression

The following map highlights areas in Missouri that have implemented a tax to support children. Click on the county or City of St. Louis to see important tax facts for the 9 counties with the tax, and to read inspiring stories about how the tax is improving the lives of children in each of the counties that have implemented the tax.

Suggested Citation:

Martinez, M., Hines, L., & Carlo, G. (2017, March). Missouri’s Tax for Children: An Investment That Counts. Family and Community Trust (FACT)—Missouri KIDS COUNT. Available at: http://mokidscount.org/stories/missouris-tax-children-investment-counts/

Acknowledgments: We would like to thank everyone who contributed to the article, whether through interviews or stories. We are grateful to the University of Missouri Center for Family Policy and Research for their expertise.

Funding for this research is generously provided by the Annie E. Casey Foundation. We thank them for their support but acknowledge that the findings and conclusions presented in this report are those of the author(s) alone, and do not necessarily reflect the opinions of the Foundation.

Download Missouri’s Tax for Children article here.

[1] The City of St. Louis is not a part of any county, and in fact operates as its own county. State law commonly refers to the City of St. Louis as a “city not within a county”.

[2] This special voter-approved tax law was not the first of its kind in Missouri. In 1969 a state law passed authorizing a voter-approved tax for a Community Mental Health Fund (RSMo 205.977) and in 1989 a state law was passed authorizing a voter-approved tax for Senior Citizens’ Services (RSMo 67.990.1). Of the counties that have passed the Community Children’s Services tax, three counties have the Mental Health tax: Jackson, Jefferson, and the City of St. Louis. Only the City of St. Louis has the Senior Tax. The City of St. Louis is the only community that has all three taxes.

[3] The authorizing legislation for the property tax includes the following uses [RSMo 210.861.4]: (1) Up to thirty days of temporary shelter for abused, neglected, runaway, homeless or emotionally disturbed youth; respite care services; and services to unwed mothers; (2) Outpatient chemical dependency and psychiatric treatment programs; counseling and related services as a part of transitional living programs; home-based and community-based family intervention programs; unmarried parent services; crisis intervention services, inclusive of telephone hotlines; and prevention programs which promote healthy lifestyles among children and youth and strengthen families; (3) Individual, group, or family professional counseling and therapy services; psychological evaluations; and mental health screenings.

[4] The tax cannot be used for transportation or for inpatient medical, psychiatric or chemical dependency services.

March 14, 2017